The beverage market has seen a decline in consumption. Kofola still manages to maintain its annual EBITDA guidance

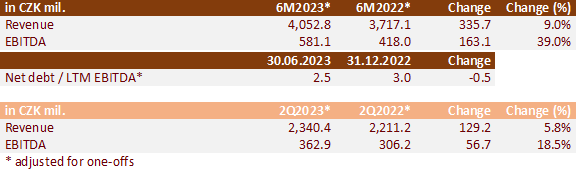

Kofola ČeskoSlovensko has published its Q2 results. Profit margin is starting to approach pre-pandemic levels. Despite a decline in the volume of litres sold, it reported EBITDA of CZK 581 million for the first half of the year. New products launched in all markets have won the hearts of consumers. The fresh UGO division continues its growth trend, even breaking into the black at the net profit level in Q2.

Although the beverage market has long been under pressure from falling consumption, the summer season is usually a key period for beverage companies. Thanks to strategic management and ideal portfolio diversification, the Kofola Group achieved total sales of CZK 4,053 million crowns for the first half of 2023.

The new products launched by Kofola contributed positively to the revenues achieved. These included Semtex Extrem, a non-taurine energy drink, Targa Florio tonics with Sicilian ingredients and Jupík popsicles, which the company launched in cooperation with Bidfood.

"From our point of view, the season is slightly below expectations. After a three-year period of crisis, we are slowly returning to the normality and stability to which we have become accustomed. In 2019, we were operating with an EBITDA margin of 20%, and we are currently still below that. Our clear goal is to return to pre-crisis levels," says Daniel Buryš, CEO of Kofola in the Czech Republic and Slovakia.

Slovenia and Croatia experienced the same trends - Kofola's sales in the Adriatic were slightly below expectations in Q2. "Consumption was affected not only by economic factors, but also by rainy weather," summarizes Marián Šefčovič, CEO of Radenska Adriatic. In July, the Adriatic company faced very challenging weather with many storms and hurricane force winds, which also caused material damage at both of its production plants in Radenci and Lipik. However, production was not affected by the natural disasters. "We are proud of the results of our innovations - Radenska FunctionALL functional waters in particular have been a hit with consumers. Thanks to the stabilized energy price and cost optimization, we are still on track to meet our planned annual EBITDA," confirms Marián Šefčovič.

Within the Kofola Group, the fresh UGO division performed beyond expectations. The Quick Service Restaurants (QSR) segment exceeded its sales forecast. "We increased it by 22% compared to last year. We were helped by portfolio optimization and the loyalty program. Thanks to it, we were able to attract more new customers. The high quality of service contributed to an increase in the frequency of visits," says Marek Farník, the company's founder and CEO. "Thanks to higher sales, better productivity and lower energy prices, UGO even made a net profit in Q2, which we are very happy about and we believe that this trend will continue," concludes Marek Farník.

In view of the good result to date, Kofola's management has decided to propose to the General Meeting the payment of a 2022 dividend of CZK 13.50 per share before tax. The Annual General Meeting (AGM) will be held outside of the meeting and Kofola will announce details of the vote (which will take place from 4 to 19 September) on 4 September 2023. If the AGM approves the dividend, the record date for entitlement to the dividend will fall on 29 September 2023.